How Banks, FinTechs and a local grocery store are fighting to win Mexico's digital economy

- Geoffrey Charles

- Jul 27, 2019

- 6 min read

Updated: Aug 14, 2019

In Mexico, Cash is King

Mexico is still a cash based economy. Cash accounts for more than 90% of consumer transactions based on a report by PYMNTS in 2018. While 85% of people in Mexico own a smartphone, only 40% of the adult population have access to a bank account at the end of last year, according to the IFC. Many consumers resolve to saving cash at home using lock boxes and making payments using their local grocery stores.

One of the biggest reasons for the reluctance to use digital payments is distrust in the banking system. There are a few hypothetical drivers for this:

High fees. BBVA, the largest bank in Mexico, charges monthly fees of close to $10 if there is low balance in the account, in addition to fees for issuing more than 5 checks, losing a debit card and requesting printed bank statements, etc. This shuts out many low income consumers.

Past scandals such as the 1994 Tequila Crisis and HSBC's money laundering scandal of 2008 have made consumers uneasy about using banks.

Desire to stay off the radar of tax collectors.

Poor user experience online and customer service in stores.

Low adoption of digital payments by merchants.

Another possible reason is Mexico's culture focused on physical goods, contact, and money. "You need to understand that the culture here in Mexico is very different here," says Ricardo Combariza of Conekta. "People like the touch things, like shaking hands a long time when saying hi. People want to share affection by giving hugs, which in the past was to make sure you weren't holding any guns. People trust the physical, not the digital."

Consumer that are part of the formal economy mostly use banks to receive their paycheck which they quickly cash out on paydays.

Yet Digital Payments are essential for financial inclusion

Studies spearheaded by UN-backed Better Than Cash Alliance, a global partnership aiming to accelerate the transition from cash to digital payments, identified many benefits for economies moving from a cash based economy to a digital one:

Cost saving: Moving from cash and check to digital payments significantly reduces cost to governments and businesses.

Transparency: Digital payments are more traceable which reduces fraud and inaccuracies with government and business payments.

Speed and security: Digital payments can be instantaneous, reducing the time the payee must wait to receive their paychecks and increasing their security.

Financial inclusion: Digital business and government payments can be the first entry point for unbanked people to financial services.

Economic development: More digital payments leads to an increase in GDP of between 0.3% (developed) and 0.8% (emerging).

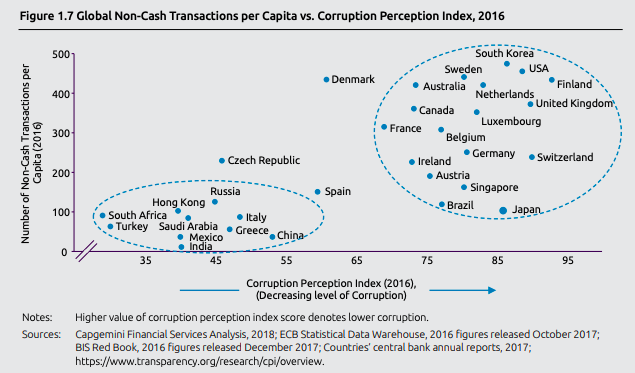

Furthermore, Digital payments are an important factor when it comes to developing economies and fighting against corruption. The World Payments Report 2018 by Capgemini found a correlation between the penetration of non cash transactions per capita and the level of perceived corruption, with Mexico lagging far behind western economies.

Oxxo local stores are currently bridging the gap

So how do Mexicans pay for bills and online transactions? The answer: their local convenience store. Oxxo began facilitating payments for the unbanked in their retail stores in 2012 after Mexican regulators allowed retailers to perform certain banking operations. Customers can use the store to make payments to their landlords or retailers for example. With more than 30,000 stores in Mexico, Oxxo is more likely to be at your street corner than a bank branch or ATM.

Oxxo is an example of an innovative player positioning themselves between as the glue between the digital and the physical world. This is important since only 3.9 percent of retail sales were made online in Mexico last year, according to research firm Euromonitor International, with Amazon and MercadoLibre among the biggest players. In Mexico, online stores help consumers make purchase decisions and find stores, but most purchases still happen in person.

That's all about to change. E-commerce is growing fast at a compound annual growth rate (CAGR) of 40.8% from 2012 to 2016, anticipated to hit US$35.8bn by 2020. Tied with the expansion of e-commerce is the take up of digital payments that powers it - a trend that the government is supporting and FinTech startups are trying to capitalize on.

Mexico's Government is investing in new technology

The Mexican government is trying change the narrative. Currently, it is building a digital payments system to enable free payments between consumers and merchants through smartphones, backed by the central bank. The program known as Cobro Digital (“digital charging”) or CoDi for short is currently being rolled out. Merchants will be able to accept instant payments via QR codes generated by the app leveraging the country’s existing payments rails, the SPEI.

The program is facing a few challenges however - first it requires consumers and merchants to have a formal bank account, creating a Catch 22 since consumers do not trust the banks. Additionally, banks and governments have a poor track record of good user experience and technological adoption by the masses.

Rather than define the product, government should invest in efficient protocols on top of which FinTechs can scale. In India for example, the National Payments Corporation of India (NPCI) introduced a method called UPI – Unified Payments Interface which accelerated digital payment adoption. UPI is a payments system that facilitates instant fund transfer between two bank accounts on a mobile platform. It has become popular for startups and banks alike as it reduces friction, cost and increases security. Today, 144 banks and almost every mobile wallet have integrated UPI payments, accounting for over 50% of India's digital payments.

FinTechs are rising up to the occasion

If consumers don't trust the banks in Mexico, maybe new FinTech companies can change the game. FinTech entrepreneurship is on a rise: a recent report by Finnovista states that "with an 18% growth and around 100 new Fintech startups, Mexico consolidates itself as an undisputed leader in Financial Innovation in Latin America". Close to 40% of these startups are focusing on Lending or Payments & Remittances.

This trend is supported by recent legislation called Financial Technology Institutions Law (Fintech Law) released in March, 2018. The "Ley" intends to build a regulatory framework aims to support innovation, competition and financial inclusion in Mexico by differentiating the level of regulation for FinTech players based on their stage and business models. While the law still has many holes and grey areas that leave some FinTechs struggling to understand and comply, its existence is a step in the right direction. There is opportunity for FinTechs to work closer with policy makers to make laws more clear and impactful.

While the success of most of these companies in Mexico remains to be seen, there are already some winners that use leverage from other services to promote financial services:

Leveraging physical stores with Conekta: Conekta, a digital payments startup which connects online merchants with offline payments through Oxxo. The service called Oxxo Pay enables customers to pay for items or bills online by choosing Oxxo Pay at checkout and then paying Oxxo in cash after giving them the unique serial number for the transaction. "We started with building out online checkout solutions, and realized that the biggest opportunity was to find a way to put cash into the system," says Ricardo. One of their biggest advantages is their physical presence in the communities via Oxxo. Not only can you pay in an Oxxo but also pick up merchandize from select partners such as Amazon.

Leveraging lending with Kueski: Kueski is the largest online consumer lender in Mexico, having distributed more than 1,000,000 loans as of January 2019. Back in 2018, Kueski released Kueski Pay which enabled merchants to provide a point of sale financing for consumers when shopping online. Leveraging their expertise in consumer underwriting, Kueski can offer affordable and convenient credit options for consumers, similar to Affirm in the United States. Kueski boasts a 82 NPS score which is significantly higher than the Mexican Banks who average a low 28 points. Kueski's goal is to provide an ecosystem of financial products for the mobile generation who have been left out - lending and payments is just the start.

Leveraging food delivery with Rappi: Rappi is a Colombian on demand delivery service company that has expanded all over Latin America thanks to a $1bn investment from Softbank. Rappi now offers payment services such as RappiPay that enables consumers to pay for their goods via Rappi. The company also offers a cash withdrawal feature, allowing users to pay with credit cards and then receive cash from one of Rappi’s delivery agents. It also plans to launch a debit card in Mexico soon. This is a similar model that is playing out successfully with WeChat in China (with WePay) and GoJek in Indonesia (with GoPay). WeChat in China for example is a chat platform that has expanded into financial service using innovative techniques such as digitalizing China's gifting culture at New Years. It now owns 37% of digital payments in China, second behind Alipay.

The fight for Mexico's digital payments has just begun and whether banks, FinTechs, and non traditional players will win remains to be seen. Better user experience and marketing, paired with more transparent fees and reliable service, could give FinTech the edge over banks in gaining user trust. In other emerging markets such as China, India and Kenya, phone-based banking is popular and has been driven by user-friendly, affordable apps from private companies. In addition, better technology, richer datasets and a culture of rapid experimentation with new products will continue to push FinTechs to innovate and win.

KrogerFeedback 50 Fuel Points Survey is a measurement to Know customer satisfaction level of the customers who shop with the Kroger grocery stores. So Kroger.com online grocery stores decided to benefit customers by offering 50 fuel points for participating in kroger.com feedback survey, additionally opportunity to get high value gift cards that can be redeemable at stores. Get your shopping list ready to shop at Kroger Stores and get back to home with free 50 fuel points on taking survey at official www.kroger.com/feedback/. However you can redeem this Kroger fuel points obtained from Official Krogerfeedback at participating fuel centers. To Improve the chances of winning take more surveys with Kroger. Family of Stores : Kroger.Co, Ralphs, Dillons, Smith's, King Soopers,…